Close

| The Septembers PSD2 Directive is fast approaching. The nervousness is visible not only in the banking industry but also among the clients and the press. Until recently, the hottest subject was Open Banking, and now the most frequently discussed issue is the Strong Customer Authentication requirement. In short, it consists of providing at least a double layer of customer protection in the form of:

1. Something You know – the password and login

source: https://eba.europa.eu/documents/10180/2622242/EBA+Opinion+on+SCA+elements+under+PSD2+.pdf The banks approached individually to implement SCA – compliant methods, applying them in various variants and combinations. Some ways are costly; others process data that very sensitive. Specialists from UX pay attention to the fact that each additional interaction on the part of the client may reduce the convenience of using the website. Some banks provide authentication via a mobile application, which, according to experts, seems to be a safer and cheaper option than text messages. However, it requires conscious user interaction.

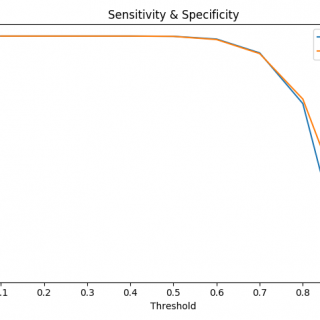

Digital Fingerprints is a product based on behavioural biometry and is such a solution that can help in everyday use of electronic banking. It is an innovative security system that is observing human interaction with a computer. It is essential, among other things, how you type on the keyboard – how quickly you press the keys and in some way move the mouse – how fast and with what acceleration. Our priority when providing the service is the privacy and ethics of data processing. We do not collect data that is considered sensitive or uniquely identifying the user. We do not want to know what you are doing, but HOW you do it. Our solution is compliance with the GDPR and most importantly, with the SCA PSD2 requirement. The use of behavioural biometry as the next layer of protection helps detect attacks such as sim card cloning and identity theft. It does not require additional user interaction and works in the background without affecting the comfort of using the website.

|

Digital Fingerprints S.A. ul. Gliwicka 2, 40-079 Katowice. KRS: 0000543443, Sąd Rejonowy Katowice-Wschód, VIII Wydział Gospodarczy, Kapitał zakładowy: 4 528 828,76 zł – opłacony w całości, NIP: 525-260-93-29

Biuro Informacji Kredytowej S.A., ul. Zygmunta Modzelewskiego 77a, 02-679 Warszawa. Numer KRS: 0000110015, Sąd Rejonowy m.st. Warszawy, XIII Wydział Gospodarczy, kapitał zakładowy 15.550.000 zł opłacony w całości, NIP: 951-177-86-33, REGON: 012845863.

Biuro Informacji Gospodarczej InfoMonitor S.A., ul. Zygmunta Modzelewskiego 77a, 02-679 Warszawa. Numer KRS: 0000201192, Sąd Rejonowy m.st. Warszawy, XIII Wydział Gospodarczy, kapitał zakładowy 7.105.000 zł opłacony w całości, NIP: 526-274-43-07, REGON: 015625240.